Get an SBA 7(a) Loan for Your Small Business

If you’re looking for small business financing, and you’ve exhausted all the conventional options, the SBA 7(a) loan could be a great way to fund your business. Right now, the SBA 7(a) loan is the most popular loan guaranteed by the U.S. Small Business Administration (SBA), with $25.8 billion of loans approved in 2017 alone. Here are a few facts about SBA 7(a) Loans:

Loan Size: Can provide up to $5 million of capital for small businesses

Loan Term: Have loan terms of up to 10 years for working capital and 25 years for real estate

Interest Rates: Most loans currently have interest rates between 7.75% and 10.25% (as of July 2019) depending on loan size and maturity

Loan Use: Can be used for working capital, equipment, buying a business or franchise, refinancing debt, and purchasing real estate

Credit Requirement: Typically require a credit score of around 680

Down Payments: Usually require a 10% to 20% down payment, as well as a certain amount of collateral

Timing: SBA 7(a) loans can be approved in between 1-10 days, depending on the lender

Comparing the Different Types of SBA 7(a) Loans

It’s tricky to navigate the wide world of SBA loans. Here, we examine several types of SBA loans available to business owners. The standard SBA 7(a) loan is the most common, but it’s important to discuss with your lender which loan is best suited for your needs.

SBA 7(a) Standard Loan

If you’re considering a SBA 7astandard loan, the turnaround time can be as short as five to 10 days. Some SBA-qualified lenders can also be granted authority to approve your loan without the SBA’s review, making the process faster.

The maximum loan amount for a standard 7(a) loan is $5 million. The SBA will guarantee this type of loan for up to 85% for loans smaller than $150,000 and 75% for loans greater than $150,000. Interest rates are negotiated between the lenders and borrowers, but that percentage may not exceed the SBA maximum rate.

Qualified lenders can fill you in on requirements for collateral, which is based on the amount you’re requesting. For loans of less than $25,000, qualified lenders aren’t required to request collateral, and for loans in excess of $350,000, the SBA requires that the qualified lender collateralize the loan to the maximum extent possible (up to the loan amount).

If your business’s fixed assets don’t fully secure the loan amount, the lender may include trading assets (using 10% of the current book value for the calculation). They must also take available equity in the personal real estate (residential and investment) of the principals as collateral.

SBA 7(a) Small Loan

The SBA 7(a) small loan option can be used for smaller loans of up to $350,000. As with the standard loan, the SBA will guarantee this type of loan for up to 85% for loans smaller than $150,000 and 75% for loans greater than $150,000. Interest rates are negotiated between the lenders and borrowers, but that percentage may not exceed the SBA maximum rate.

Collateral works the same way with the 7(a) small loan as it does with the standard 7(a):

For loans of less than $25,000, qualified lenders aren’t required to request collateral.

For loans in excess of $350,000, the SBA requires that the qualified lender collateralize the loan to the maximum extent possible (up to the loan amount).

SBA Express Loan

The SBA 7(a) Express loan is also used for loans of under $350,000, but the turnaround time is within 36 hours. This quick turnaround changes the percentage that the SBA will guarantee to only 50%. This revolving line of credit can be up to seven years with a maturity extension allowed at the time of application.

SBA 504 Loan

The SBA 504 loan is used for economic development and can’t be used for working capital or inventory. This loan often offers a lower down payment, lower interest rates, and lower fees, depending on the economic development project size.

SBA CAPLines Loan

SBA CAPLines loans are lines of credit for businesses’ cyclical or short-term needs. They feature four specific lines:

Seasonal CAPLine: Borrowers can only use the loan proceeds for seasonal increases of accounts receivable and inventory.

Contract CAPLine: This is for the direct labor and material costs of fulfilling assignable contracts (revolving or non-revolving).

Builder’s CAPLine: This is for the direct labor and material costs of an individual general contractor or builder that constructs/renovates commercial or residential buildings. The building project will be the collateral.

Working Capital CAPLine: This is an asset-based revolving line of credit for businesses that can’t meet the credit standards of long-term credit. Repayment is made by converting short-term assets into cash, which is given to the lender.

SBA Export Working Capital and Export Express Loans

Export Working Capital loans are for businesses that can generate export sales and that require additional working capital for these sales. Lenders review and approve applications, and submit the request to the U.S. Export Assistance Center location servicing the exporter's region.

The Export Express program gives exporters and lenders a more efficient way to get financing backed by the SBA for loans and lines of credit of up to $500,000. Each lender has an individual credit decision process and loan documentation. The SBA will respond to your application within 24 hours.

SBA Veterans Advantage

If you’re a veteran and small business owner, we thank you for your service, and hope you take a look at the SBA Veterans Advantage loan, which comes with reduced fees.

Eligibility requirements state that the business must be 51% owned by honorably discharged veterans, Active Duty Military service members, Active Reservists, and/or National Guard members; or a current spouse of any of the previously mentioned groups. This loan can also be extended to the widowed spouse of a service member who died while in service.

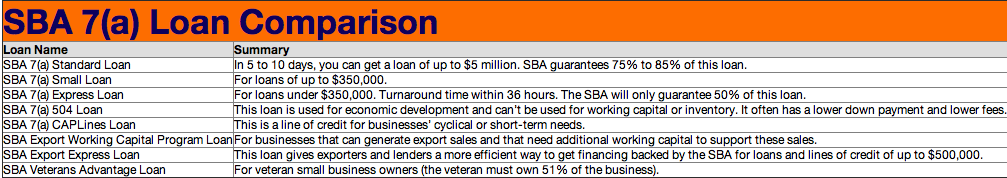

Below is a quick-reference table summarizing the types of loans available.

Using an SBA 7(a) Loan for Working Capital

One of the best uses of the SBA 7(a) loan is to get more working capital for your business or startup.

A business can’t operate without the funds to buy inventory, hire staff, and get the word out to customers. The working capital you need to run your business isn’t always readily available, however, and that’s where a loan from the Small Business Administration can help. The SBA family of loans allow businesses to use the funds for a wide array of purposes – including for working capital.

But Before We Talk Working Capital: What is the SBA 7(a) Loan?

SBA 7(a) loans are offered by the United States Small Business Administration, but the SBA itself doesn’t lend money -- they operate as an insurer. Banks, credit unions, or other lending institutions offer the actual loan product to the business, and the SBA backs the loan, ultimately reducing the amount of risk the lender takes on.

The loan can be used to buy real estate or land, treated like working capital, or spent on equipment costs. Small businesses can also use the SBA 7(a) loan to refinance existing debt.

Because your lender will need to get approval from the SBA to back your loan, the application process and paperwork for an SBA 7(a) loan can be lengthy. However, these loans typically boast better terms than traditional small business loans, and sometimes even come with counseling to ensure your business runs efficiently.

What Types of SBA Programs are Available for Working Capital?

The SBA 7(a) is the administration’s flagship term loan program. However, the SBA also offers specialized loan programs for certain circumstances. Some loan programs small businesses that need working capital might qualify for include:

CAPLines – A revolving line of credit for financing seasonal or short-term needs. CAPLine loans that will be used for working capital require the borrower to show that their business generates accounts receivable and/or has inventory already.

International Trade – For businesses that need funds to export internationally. This program offers up to a $4 million guarantee for working capital

Export Working Capital – provides additional funding to increase domestic export sales without disrupting your business plan. This program allows for advances of up to $5 million to fund export transactions. These loans require that the business has been established for at least 12 months, and that the Export Management Company or Export Trading Company will take the title to the goods or services being exported, and the EMC or ETC has no bank ownership.

Microloans – SBA-backed loans up to $50,000

Who Qualifies for the SBA 7(a) Loan?

SBA 7(a) loans have attractive interest rates, repayment terms, and closing costs, but they do have stricter qualification requirements than other business loans. Generally, in order to qualify for one, you’ll need:

A credit score of at least 690

A record free of any bankruptcies in the past three years

At least a 10% down payment

For franchisees, a paid franchise fee before the loan funds are released

A clean criminal history, or the ability to explain any misdemeanors on your record

No current Federal debt

In addition, the business that will benefit from the loan will generally need to be:

A for-profit entity

A small business

Based in the United States

A business with invested equity

A business that has exhausted its other financing options

These requirements ensure that the loan is eligible for SBA backing. If the loan is ineligible, you’ll need to seek other forms of small business financing.

Who Guarantees the Working Capital Loan?

All owners of your business who have at least 20% equity in the company will be required to guarantee the loan, and you’ll need to include the names and information for each of these owners in your application paperwork. In addition, if your spouse has at least 5% equity in the company and you and your spouse’s equity totals at least 20% (for example, if you have 15% equity and your spouse has 5% equity), your spouse will have to guarantee the loan, too.

One distinction: if you are a sole proprietor, you will not need to provide a separate personal guarantee for your SBA loan because you execute the note yourself as a borrower (instead of as a business).

What Counts as Working Capital?

Generally, working capital is the operating liquidity available to a business. You can calculate your business’s working capital by subtracting the business’s current liabilities from its current assets.

You may need additional working capital to:

Pay expenses

Pay debt

Take advantage of business opportunities

Invest money ahead of seasonal changes

Increase business health with cash on hand

How Can I Use the Loan Proceeds to Fund My Projects?

If your business is upside down on its working capital ratio (in other words, if you have more liabilities than assets), you may need more working capital to operate, pay bills, or even to secure affordable financing. If your small business is growing, you may need more working capital to help you achieve your goals, like hiring more employees, securing more contracts, marketing your product, or increasing your inventory.

What Documentation Will I Need to Provide?

Your lender will need specific information about your business, including the business type, size, age, location, and industry. You’ll also fill out forms providing your lender with your personal information, like your legal name, address, and immigration status.

The forms and documents commonly required in the application package include:

SBA Form 1919 (borrower information form)

SBA Form 912 (statement of personal history)

SBA Form 413 (personal financial statement)

Business and affiliate financial statements, including a balance sheet, profit and loss, and income projection

The SBA allows applicants to get help (for example, from a lawyer or a translator) filling out the application paperwork, but your lender will be required to submit information about who gave you help to the SBA, so you’ll need to document who this person is as well.

I'm Ready for a Working Capital Loan! (Next Steps)

Once you’ve decided that an SBA 7(a) loan is for you, you’ll need to contact a lender to help you get started. The paperwork, terms, and jargon involved in putting together an application package for an SBA loan can be overwhelming. You can get personalized guidance at HiTech Capital. Because we live and breathe the SBA 7(a) loan process, we know how to help you at every stage. We match business owners like you with the best lender for your situation, even if it means that we have to look outside of the SBA 7(a) loan platform. We serve our customers by 1) offering a free educational portal, and 2) leveraging our lender-matching service to help you on your way to success. We have a deep love of American small businesses, and we believe it shows in our customer-first attitude.